Finance

Geopolitical Tensions Creating Challenges For Swiss Firms – Though High Proportion Moving Into New Business Areas Despite Crises

Credit Suisse economists published a study on how geopolitical tensions are creating challenges for Swiss firms. A survey of 650 companies shows that a clear majority are impacted by geopolitical strains including non-tariff barriers, increased regulatory density and business risks, as well as constraints on cross-border cooperation. The firms are defying these challenges through adjustments to their value chains, measures to combat higher input prices, and strategies to minimize reputational risks.

The global situation was already tense when the war in Ukraine began in February 2022. A world order founded on open markets and deepening trade relations had already started to crack due to the global financial crisis and then the pandemic. In the study published today, the Credit Suisse economists examine the question of how companies are faring in these turbulent times given the major importance of international business relationships to the Swiss economy. Their analysis is based on a survey of 650 Swiss companies. To address size-specific differences, this year’s study surveyed 50 large companies as well as the SMEs.

Business relationships under pressure

The survey shows that geopolitical tensions are becoming apparent in day-to-day business life, with Swiss companies having seen an increase in business risks over the past three years. These risks are particularly pronounced in the case of Russia and Ukraine, although business risks outweigh business opportunities in Argentina, Iran, and New Zealand as well. Unsurprisingly, the list of countries from which Swiss companies have withdrawn in the last three years is headed by Russia: Around 6% of all companies surveyed have left the country – indeed among large companies the figure is 24%. Even so, a few of the big companies in particular are already planning to begin or resume business activities in Russia.

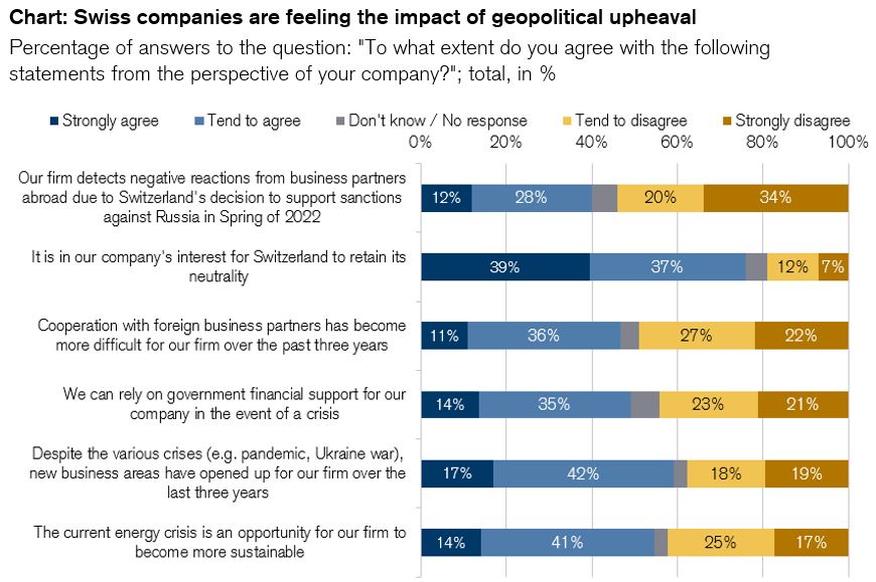

However, the impact of geopolitical tensions is not confined to companies that do business in high-risk countries: Around 40% of the companies surveyed detected negative reactions from business partners as a result of Switzerland’s decision to support the international sanctions against Russia in spring 2022 (see chart). The survey provides clear evidence of the importance of Switzerland’s neutrality for local companies, with over three-quarters of those surveyed stating that Switzerland retaining its neutrality was in their interest (see chart).

Various hurdles creating challenges for companies

Companies are affected not only by sanctions but also by customs duties and other non-tariff barriers such as government procurement regulations and approval procedures. The survey results also point to an increase in red tape: 54% of the companies surveyed said they had been affected by the increase in data protection regulations both in Switzerland and internationally over the past three years, while 51% said the same applied in the case of environmental red tape. The legal situation in relation to environmental matters in particular is changing rapidly, with the European Union (EU) playing a leading role in this regard: Companies with an EU focus reported a greater increase in regulatory density compared to those without a strong EU focus. Anti-competitive measures are likewise impacting on international cooperation. Around 47% of the companies said that cooperation with foreign business partners had become more difficult over the past three years (see chart).

Focus on supply chain stability

Swiss companies are again starting to prioritize supply chain stability and make the required changes. In addition to an increase in inventories (51% of respondents), they are also seeking to boost their resilience by focusing on providers of inputs that are closer to home (48%) and on diversifying their suppliers (43%). Nearly one in three companies has repatriated activities to Switzerland over the last three years. The survey results indicate an overall trend toward regionalization.

The crises of recent years, associated changes along supply chains, as well as anti-competitive measures are not only weighing on global trade but also leading to rising prices. The survey results show that more than 80% of the companies surveyed have seen an increase in transportation and energy costs as well as commodity prices over the past three years. Sooner or later, this broad-based rise in prices will not be sustainable for the companies concerned. Unsurprisingly, almost 90% of companies are doing something about it. More than half of the companies surveyed have responded by passing on higher costs to customers. The search for cheaper substitutes (35%) and productivity increases (26%) were also cited by many respondents. By contrast, only around 7% of the companies surveyed said they had considered shrinkflation – selling a smaller amount of product for the same price as before – in a bid to offset rising input prices.

Preserving a good reputation

Reputational risks are likewise increasing amid the harsh geopolitical environment. According to the survey, almost one in five companies believes there is a strong or very strong likelihood of public criticism due to their own misconduct or misconduct by a business partner. This situation is forcing companies to spend more time and money on monitoring and preventing potential reputational risks. Fact is, a firm that fails to conduct due diligence can expect criticism or even a boycott of their products and services. The survey shows that 19% of companies consider this scenario to be likely. However, there is also a risk of reputational damage if sensitive information – due to a cyber-attack, for example – is made public. Nearly a third of companies see this as at least a fairly high risk. Against this backdrop, it is hardly surprising that around 83% of the companies surveyed are taking measures to combat increased reputational risks. The most common approaches are measures to prevent cyber-attacks (41%) as well as changes to products and services to meet the needs of stakeholders (38%).

Turbulent times call for flexibility

Given the rapid succession of crises, the focus is on how Swiss companies can adapt and react to unforeseen events. As the survey shows, around 40% of companies see themselves in a good or very good position in this regard – with only 22% disagreeing. When asked about the obstacles to a possible reorientation of business activities, around 70% of companies reported financial resources or a lack of alternatives; meanwhile, 61% cited the lack of support from government. At the same time, however, almost half of the companies surveyed are convinced that they can rely on government support in the event of a crisis (see chart).

Crises always present opportunities, provided a sufficiently flexible approach is taken. Almost 60% of the companies said that new business areas had emerged despite the crises of the last three years (see chart). Swiss companies even see the positive side of the current energy crisis: More than half believe it represents an opportunity for them to become more sustainable (see chart).

Credit Suisse

Credit Suisse is one of the world’s leading financial services providers. The bank’s strategy builds on its core strengths: its position as a leading wealth manager, its specialist investment banking and asset management capabilities and its strong presence in its home market of Switzerland. Credit Suisse seeks to follow a balanced approach to wealth management, aiming to capitalize on both the large pool of wealth within mature markets as well as the significant growth in wealth in Asia Pacific and other emerging markets, while also serving key developed markets with an emphasis on Switzerland. The registered shares (CSGN) of Credit Suisse Group AG, are listed in Switzerland and, in the form of American Depositary Shares (CS), in New York. Further information about Credit Suisse can be found at www.credit-suisse.com.

-

Auto2 years ago

Auto2 years agoHonda Marine Debuts All-New BF350 Outboard Company’s First V8 Motor Available Commercially, Flagship Model Offers Premium Power and Unparalleled Performance for Extraordinary Boating Experiences

-

Auto2 years ago

Auto2 years agoNew Features Further Increase Desirability Of Bentayga Range

-

Technology2 years ago

Technology2 years agoOracle Partners with TELMEX-Triara to Become the Only Hyperscaler with Two Cloud Regions in Mexico

-

Auto2 years ago

Auto2 years agoHonda and Acura Electric Vehicles Will Have Access to Largest EV Charging Networks in North America Aided by New Agreements with EVgo and Electrify America

-

Lifestyle2 years ago

Lifestyle2 years ago2023 Nike World Basketball Festival Brings the Best of Basketball Style, Culture and Community