Finance

Australians’ Financial Wellbeing Declines As Cost Of Living Pressures Rise

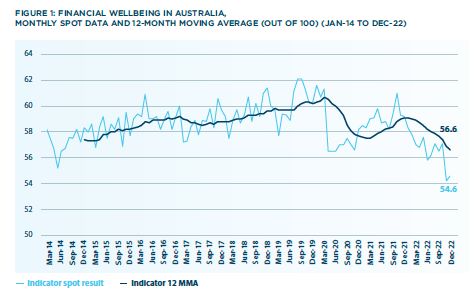

The ANZ Roy Morgan Financial Wellbeing Indicator (FWBI) update examines how financial wellbeing changed in the last quarter of 2022 and year-on-year, comparing the December 2022 results with those of September 2022 and December 2021.

The quarterly report illustrates that while the financial wellbeing of Australians had already declined in the first three-quarters of 2022, rising cost of living pressures continue to have an impact on Australian households.

Released , the FWBI provides a snapshot of the personal financial well-being of Australians. It shows rising inflation and interest rates have resulted in all states and the ACT recording lower overall financial wellbeing scores in December 2022 compared to September 2022.

Reported as a 12-month moving average each quarter, the indicator also shows a further decline in Australians’ financial wellbeing since results collected in 2022 post-COVID.

The quarterly update also found:

- The proportion of respondents with the lowest financial wellbeing scores has risen from 10.5% in January 2019 to 17.2% in December 2022 across all states and the ACT. The initial increase coincided with the onset of COVID and rising unemployment and accelerated in 2022 with rising inflation and interest rates. (See figure 4.)

- Tasmania saw the sharpest year-on-year fall in financial wellbeing (down 5.4%), followed by the ACT (down 5.1%) and Queensland (down 4.9%). Despite the fall, respondents from the ACT continued to show the highest level of financial wellbeing, remaining above the national average, followed by Victoria.

ANZ has been exploring the financial literacy, capability, attitudes, and behaviours of Australian adults for almost 20 years through a number of financial wellbeing programs and research.

ANZ is committed to improving the financial wellbeing of all Australians and has developed programs such as MoneyMinded and Saver Plus in consultation with community partner organisations and government to provide real social benefits to the community and improve financial inclusion and wellbeing.

Powered by the Roy Morgan Single Source Survey, the ANZ Roy Morgan Financial Wellbeing Indicator provides unique, regular insights into Australians’ financial wellbeing.

About the ANZ Roy Morgan Financial Wellbeing Indicator:

The ANZ Roy Morgan Financial Wellbeing Indicator (FWBI) provides insights into how factors affecting the financial lives of Australians are impacting their financial wellbeing outcomes over time. The FWBI is reported as a 12-month moving average, with regular updates showing the movement in aspects of financial wellbeing across locations and for a range of segments in the community. For more information on financial wellbeing at ANZ visit https://www.anz.com.au/about-us/esg/financial-wellbeing/.

Source – ANZ

-

Auto1 year ago

Auto1 year agoHonda Marine Debuts All-New BF350 Outboard Company’s First V8 Motor Available Commercially, Flagship Model Offers Premium Power and Unparalleled Performance for Extraordinary Boating Experiences

-

Lifestyle1 year ago

Lifestyle1 year ago2023 Nike World Basketball Festival Brings the Best of Basketball Style, Culture and Community

-

Auto1 year ago

Auto1 year agoNew Features Further Increase Desirability Of Bentayga Range

-

Lifestyle1 year ago

Lifestyle1 year agoNike Debuts the ISPA Link Axis, an Exploration Into Circular Design

-

Auto1 year ago

Auto1 year agoHonda and Acura Electric Vehicles Will Have Access to Largest EV Charging Networks in North America Aided by New Agreements with EVgo and Electrify America